Why inflation may be worse than you think it is

Moderator: Community Team

Re: Why inflation may be worse than you think it is

Weren’t you “FOEING” me?

I’m pretty sure if you “FOE” me you can’t read my posts…. not unless you specifically look.

You asked me if if I grab my crotch. I answered. I’m sorry you can’t follow.

Still waiting for you to explain how you “proved me wrong”. Not sure what you think I was even wrong about.

I’m pretty sure if you “FOE” me you can’t read my posts…. not unless you specifically look.

You asked me if if I grab my crotch. I answered. I’m sorry you can’t follow.

Still waiting for you to explain how you “proved me wrong”. Not sure what you think I was even wrong about.

-

jimboston

jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Why inflation may be worse than you think it is

jimboston wrote:Weren’t you “FOEING” me?

I’m pretty sure if you “FOE” me you can’t read my posts…. not unless you specifically look.

You asked me if if I grab my crotch. I answered. I’m sorry you can’t follow.

Still waiting for you to explain how you “proved me wrong”. Not sure what you think I was even wrong about.

I FOED you; you LOST that one, Jimmy-B

I decide when I want to read your stuff, that is MOSTLY garbage and full insults and denigrating remarks. This is "on the border" but did not cross the line, imo. And yes, I have to "click" to read your posts; that was FOEing does.

I think it is time to ignore you and ralph, again. I am no longer bored.

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

jusplay4fun wrote:jimboston wrote:Weren’t you “FOEING” me?

I’m pretty sure if you “FOE” me you can’t read my posts…. not unless you specifically look.

You asked me if if I grab my crotch. I answered. I’m sorry you can’t follow.

Still waiting for you to explain how you “proved me wrong”. Not sure what you think I was even wrong about.

I FOED you; you LOST that one, Jimmy-B

I decide when I want to read your stuff, that is MOSTLY garbage and full insults and denigrating remarks. This is "on the border" but did not cross the line, imo. And yes, I have to "click" to read your posts; that was FOEing does.

I think it is time to ignore you and ralph, again. I am no longer bored.

Yet the whole purpose of Foeing is so you won’t.

If you just click to read all my posts it’s more like you’re “Friending” because it shows how concerned and obsessed you truly are.

Now I’m adding Cap’t Pointless to the list of idiotic traits that make you you.

-

jimboston

jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Why inflation may be worse than you think it is

Germany

Germany’s Finance Minister Christian Lindner said on Tuesday that high inflation in Germany was eroding economic foundations, as reported by Reuters.

"We must expect 30 billion euros in 2023 for interest payments rather than 4 billion euros previously expected," Lindner added.

Raising interest rates to fight inflation is good but on the back end it increases the cost to service debt.

Germany’s Finance Minister Christian Lindner said on Tuesday that high inflation in Germany was eroding economic foundations, as reported by Reuters.

"We must expect 30 billion euros in 2023 for interest payments rather than 4 billion euros previously expected," Lindner added.

Raising interest rates to fight inflation is good but on the back end it increases the cost to service debt.

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

Cumulative effect

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

Jeff Bezos and inflation July 2022

Jeff Bezos calls out Joe Biden's latest inflation claim: 'Straight misdirection or a deep misunderstanding' (msn.com)

[.....for whatever reason, I cannot paste the URL here.]

Whatever his and your political tendencies, I would argue Jeff Bezos knows something about Economics and thus inflation.

Jeff Bezos calls out Joe Biden's latest inflation claim: 'Straight misdirection or a deep misunderstanding'

July 3 2022

Jeff Bezos calls out Joe Biden's latest inflation claim: 'Straight misdirection or a deep misunderstanding' (msn.com)

After President Joe Biden called on companies running gas stations to lower the price of gas, Jeff Bezos accused the U.S. president of misleading the public or said he lacked a "basic" understanding of the forces that actually drive prices.

"Ouch. Inflation is far too important a problem for the White House to keep making statements like this," Bezos said in a tweet Saturday evening.

In the initial tweet, Biden made a direct appeal to gas stations and encouraged them to simply charge less for gasoline.

(…)

The president urged compliance, without any hesitation.

"And do it now," he ordered.

Bezos said the tweet was very telling to him and may reveal how little Biden knows about the market.

"It’s either straight ahead misdirection or a deep misunderstanding of basic market dynamics," Bezos added in his response.

Jeff Bezos calls out Joe Biden's latest inflation claim: 'Straight misdirection or a deep misunderstanding' (msn.com)

[.....for whatever reason, I cannot paste the URL here.]

Whatever his and your political tendencies, I would argue Jeff Bezos knows something about Economics and thus inflation.

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

History of banking in the US and Canada.

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

HitRed wrote:History of banking in the US and Canada.

and your point?

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

HR said:

I think I said that already.

continue to:

on March 23, 2022, in this very thread

Raising interest rates to fight inflation is good but on the back end it increases the cost to service debt.

I think I said that already.

.....have to pay THE HUGE interest payment. Forget paying off the Debt itself.

Net interest payments on the debt are estimated to total $393.5 billion this fiscal year, or 8.7% of all federal outlays.

continue to:

And with the Fed raising interest rate on the Prime, where will the amount go? UP..! of course.

on March 23, 2022, in this very thread

Last edited by jusplay4fun on Thu Jul 14, 2022 7:20 pm, edited 1 time in total.

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

Part 2. Alexander Hamilton

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

https://www.foxnews.com/world/dutch-far ... ntal-rules

Dutch farmers may be forced to cut use of fertilizer 50% and the number of farm animals 30%. Like Ukraine the Netherlands are a large exporter of food.

No word on bank accounts being frozen.

Dutch farmers may be forced to cut use of fertilizer 50% and the number of farm animals 30%. Like Ukraine the Netherlands are a large exporter of food.

No word on bank accounts being frozen.

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

@hitred... gold chart for 5d, 30d, 6m, 1 year all in the red. What's the deal, isn't gold supposed to be holding value/going up in this environment? If dollars are worth less (measured by inflation), and gold price go down it's double ended dildo no?

Dukasaur wrote: That was the night I broke into St. Mike's Cathedral and shat on the Archibishop's desk

-

mookiemcgee

mookiemcgee

- Posts: 5657

- Joined: Wed Jul 03, 2013 2:33 pm

- Location: Northern CA

Re: Why inflation may be worse than you think it is

mookiemcgee wrote:@hitred... gold chart for 5d, 30d, 6m, 1 year all in the red. What's the deal, isn't gold supposed to be holding value/going up in this environment? If dollars are worth less (measured by inflation), and gold price go down it's double ended dildo no?

One set of analysis on the prices of both Gold & Silver, and interest rates, too:

Gold and silver prices are expected to remain broadly stable or lower in 2022, with trends influenced by factors including interest rates and global monetary policy.

But analysts are divided over longer-term prospects, with some forecasting further declines and others expecting the precious metals to soar to new highs in the coming years.

Mining companies across Latin America are taking advantage of the recent rise in gold and silver prices, which have swelled cash flows and treasuries, and enabled firms to invest in optimizations of existing assets, and in some cases advance growth projects.

RECENT TRENDS

Gold has traded around US$1,800/oz in 2021, down from the record of over US$2,000/oz reached in August 2020, which followed massive fiscal stimuli in response to the COVID-19 pandemic.

While down from the 2020 peak, prices have remained far higher than the US$1,100-1,400/oz band seen for most of 2013-19.

Gold closed up 0.58% at US$1,796.35/oz in London on Wednesday.

Silver has followed a similar trajectory, rising in mid-2020 to around US$27/oz, before dropping off to around US$25/oz this year.

Prices have recently fallen further to below US$23/oz, ending up 0.75% at US$22.84/oz Wednesday, but remain higher than the US$15-20/oz levels which dominated in 2014-19.

INTEREST RATES

Currently, interest rates are the most important factor affecting precious metals prices, according to US-based consultancy CPM Group.

https://www.bnamericas.com/en/features/where-are-gold-silver-prices-headed-in-2022

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

In many of the countries around the world you would love to be in gold/silver now. In Japan, for example gold/silver is winning hands down compared to the yen. America, where I live, happens to have the world reserve currency and the dollar is now very very strong. Interest rates are rising and capital is flowing in from Europe for a safe haven. So, I might be out of luck, or maybe in a lot of luck to be in the USA. I did put my hands on some 90% this week and I’m still stacking.

Earlier this week I did ask.

Silver? -

I did pull my receipts from 2015, July 2nd

1/4 gold paid $324 and a few days ago is was up 34% -24% inflation during those years = %10 gain so gold did its job plus.

The silver purchased around that time is up +21% - 24% = -3. Basically it mostly did its job over 7 years compared with inflation.

If the dollar reverses or the Fed reverses things will change. Till then it’s a buying opportunity.

Earlier this week I did ask.

Silver? -

It is not the hour.

I did pull my receipts from 2015, July 2nd

1/4 gold paid $324 and a few days ago is was up 34% -24% inflation during those years = %10 gain so gold did its job plus.

The silver purchased around that time is up +21% - 24% = -3. Basically it mostly did its job over 7 years compared with inflation.

If the dollar reverses or the Fed reverses things will change. Till then it’s a buying opportunity.

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

HitRed wrote:In many of the countries around the world you would love to be in gold/silver now. In Japan, for example gold/silver is winning hands down compared to the yen. America, where I live, happens to have the world reserve currency and the dollar is now very very strong. Interest rates are rising and capital is flowing in from Europe for a safe haven. So, I might be out of luck, or maybe in a lot of luck to be in the USA. I did put my hands on some 90% this week and I’m still stacking.

Earlier this week I did ask.

Silver? -It is not the hour.

I did pull my receipts from 2015, July 2nd

1/4 gold paid $324 and a few days ago is was up 34% -24% inflation during those years = %10 gain so gold did its job plus.

The silver purchased around that time is up +21% - 24% = -3. Basically it mostly did its job over 7 years compared with inflation.

If the dollar reverses or the Fed reverses things will change. Till then it’s a buying opportunity.

Wait did you ask, or did God ask?

Regardless, thanks for your input. I understand gold as a store of value, certainly over longer terms and that short term is mostly irrelevant. Just seemed like a time where there would be alot of flight from fiat to gold, though interest rates rising was great input as to why investors might just prefer staying in fiat (US) right now

Dukasaur wrote: That was the night I broke into St. Mike's Cathedral and shat on the Archibishop's desk

-

mookiemcgee

mookiemcgee

- Posts: 5657

- Joined: Wed Jul 03, 2013 2:33 pm

- Location: Northern CA

Re: Why inflation may be worse than you think it is

US Inflation Quickens to 9.1%, Amping Up Fed Pressure to Go Big

Consumer price index climbed 1.3% from May, most since 2005

Increase reflected higher gasoline, shelter and food costs

US inflation roared again to a fresh four-decade high last month, likely strengthening the Federal Reserve’s resolve to aggressively raise interest rates that risks upending the economic expansion.

The consumer price index rose 9.1% from a year earlier in a broad-based advance, the largest gain since the end of 1981, Labor Department data showed Wednesday. The widely followed inflation gauge increased 1.3% from a month earlier, the most since 2005, reflecting higher gasoline, shelter and food costs.

See the graph on this link: https://www.bloomberg.com/news/articles/2022-07-13/us-inflation-accelerates-to-9-1-once-again-exceeding-forecasts#:~:text=US%20CPI%20June%202022%3A%20Inflation,Once%20Again%20Exceeding%20Forecasts%20%2D%20Bloomberg

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

Price of Oil (Crude Oil, Petroleum):

https://oilprice.com/oil-price-charts/

Just as NOT ALL the rise in the Price of oil is due to putin's invasion of Ukraine, so do the policies of the Biden Administration contributing to the increase in the price. So to is the world coming off a low due to COVID shut downs.

For those who forget, the price of gasoline (petrol, "gas") in the USA dependents as well on the switch from the winter to summer blends, and the price of gasoline usually drops after or near July 4.

Price of gasoline in the USA, 5 years:

More:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPMR_PTE_NUS_DPG&f=M

https://oilprice.com/oil-price-charts/

Just as NOT ALL the rise in the Price of oil is due to putin's invasion of Ukraine, so do the policies of the Biden Administration contributing to the increase in the price. So to is the world coming off a low due to COVID shut downs.

For those who forget, the price of gasoline (petrol, "gas") in the USA dependents as well on the switch from the winter to summer blends, and the price of gasoline usually drops after or near July 4.

Price of gasoline in the USA, 5 years:

More:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPMR_PTE_NUS_DPG&f=M

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

Today’s inflation and the Great Inflation of the 1970s: Similarities and differences

Jongrim Ha M. Ayhan Kose Franziska Ohnsorge / 30 Mar 2022

The recent commodity price surge, in the wake of Russia’s invasion of Ukraine, has exacerbated already elevated inflationary pressures. A new CEPR Policy Insight argues that over the medium term, as recent shocks unwind, inflation is expected to ease back towards targets, but the Great Inflation of the 1970s is a reminder of the material risks to this outlook. As inflation remains elevated, the risk is growing that, to bring inflation back to target, advanced economy central banks will once again need to undertake a much more forceful policy response than currently anticipated.

Much more in the article with Predictions and graphs:

https://cepr.org/voxeu/columns/todays-inflation-and-great-inflation-1970s-similarities-and-differences#:~:text=In%201970%2C%20it%20reached%205.5,7%25%20in%20March%202022).

Jongrim Ha M. Ayhan Kose Franziska Ohnsorge / 30 Mar 2022

The recent commodity price surge, in the wake of Russia’s invasion of Ukraine, has exacerbated already elevated inflationary pressures. A new CEPR Policy Insight argues that over the medium term, as recent shocks unwind, inflation is expected to ease back towards targets, but the Great Inflation of the 1970s is a reminder of the material risks to this outlook. As inflation remains elevated, the risk is growing that, to bring inflation back to target, advanced economy central banks will once again need to undertake a much more forceful policy response than currently anticipated.

Much more in the article with Predictions and graphs:

https://cepr.org/voxeu/columns/todays-inflation-and-great-inflation-1970s-similarities-and-differences#:~:text=In%201970%2C%20it%20reached%205.5,7%25%20in%20March%202022).

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

-

HitRed

HitRed

- Posts: 5105

- Joined: Fri Jun 26, 2015 12:16 pm

Re: Why inflation may be worse than you think it is

GOP-led House passes bill to hike debt limit and slash spending

The bill is going nowhere in the Senate. But Wednesday's successful vote marks a symbolic win for Speaker Kevin McCarthy, who struggled to unify Republicans behind a debt plan.

April 26, 2023, 10:53 AM EDT / Updated April 26, 2023, 6:52 PM EDT

By Scott Wong, Sahil Kapur and Alexandra Bacallao

WASHINGTON — The Republican-controlled House voted Wednesday to pass a bill to raise the debt limit, slash spending and roll back key pieces of President Joe Biden’s agenda after a series of concessions overnight to win over stubborn GOP holdouts.

The GOP debt package is dead on arrival in the Democratic-led Senate, and Biden has also issued a veto threat, saying Congress should hike the debt ceiling with no strings attached.

But passage of the bill on a 217-215 vote hands Speaker Kevin McCarthy, R-Calif., a small and much-needed symbolic victory, underscoring his ability to bring together his razor-thin, often rambunctious majority. Republicans hope that uniting behind the debt ceiling plan will pressure Biden and the Democrats to start negotiating just two months before a potential default on the nation’s debt.

“One party has taken care of the debt ceiling. We have lifted the debt ceiling. … The Democrats have not,” McCarthy told reporters after the vote. “The president wants to make sure the debt ceiling is going to be lifted — sign this bill.”

(...)

McCarthy’s bill, dubbed the Limit, Save, Grow Act, would lift the federal borrowing limit by $1.5 trillion or through March 31, whichever comes first. It would cut federal discretionary spending to fiscal 2022 levels and impose a 1% growth cap, and it would recapture unspent Covid relief funds, kill Biden’s student debt cancellation plan, rescind IRS enforcement funding and add new work requirements for able-bodied adult recipients of federal programs like Medicaid.

https://www.nbcnews.com/politics/congress/house-republicans-eye-wednesday-vote-debt-limit-bill-making-changes-rcna81326

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

and, as of today, still no progress on Inflation and better managing the US Government Debt.

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

The talks continue on raising the debt limit for the US Government. Everyday I hear a news report, but still NOTHING. I find it interesting that the liberal media reports a reduction of the increase from 5-10% to 1% a cut. It is NOT a cut, it is a reduction of the increase.

And Biden earlier did not understand (or, generously, failed to acknowledge) that the reason we are in such a huge DEBT hole is due to excessive SPENDING. What a stoopid lack of linkage.

And Biden earlier did not understand (or, generously, failed to acknowledge) that the reason we are in such a huge DEBT hole is due to excessive SPENDING. What a stoopid lack of linkage.

JP4Fun

-

jusplay4fun

jusplay4fun

- Posts: 7936

- Joined: Sun Jun 16, 2013 8:21 pm

- Location: Virginia

Re: Why inflation may be worse than you think it is

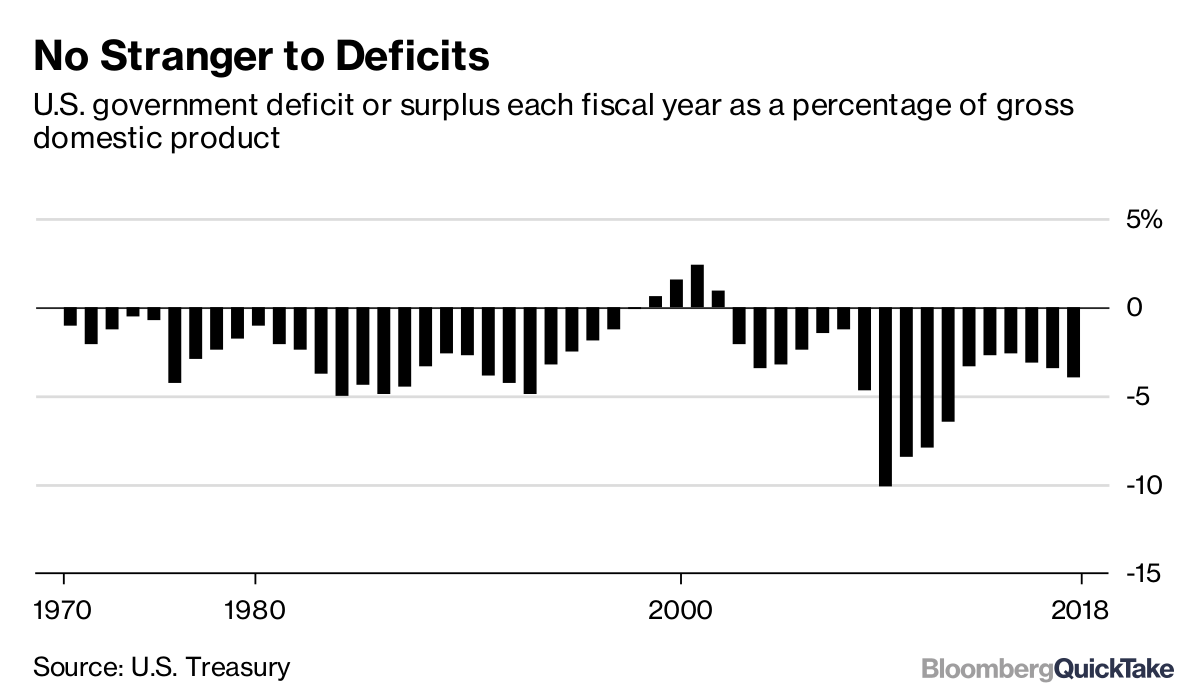

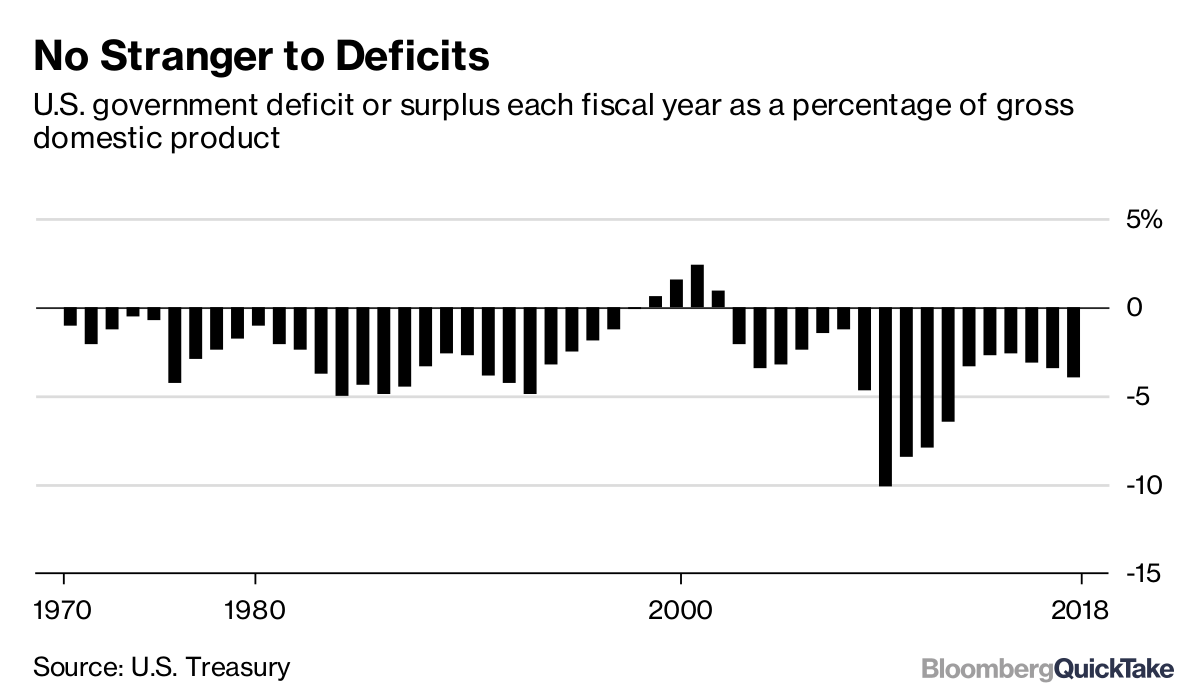

US government being in a deficit position didn't start with Biden, that's for sure.

It's been going on pretty much all of your adult life.

It's been going on pretty much all of your adult life.

“Life is a shipwreck, but we must not forget to sing in the lifeboats.”

― Voltaire

― Voltaire

-

Dukasaur

Dukasaur

- Community Team

- Posts: 28045

- Joined: Sat Nov 20, 2010 4:49 pm

- Location: Beautiful Niagara

3

3

2

2

Who is online

Users browsing this forum: No registered users